Banking is easier with

our mobile app

Features

How to register

What are the new features of the app?

Upgraded security including secret question to protect you online

Choose biometrics option with first time registration

Enhanced navigation and journeys to your favourite app functions

Personalise your app by selecting your primary account

Look Who's Charging integration - view payments by category

Dashboard for a quick and easy view of your accounts

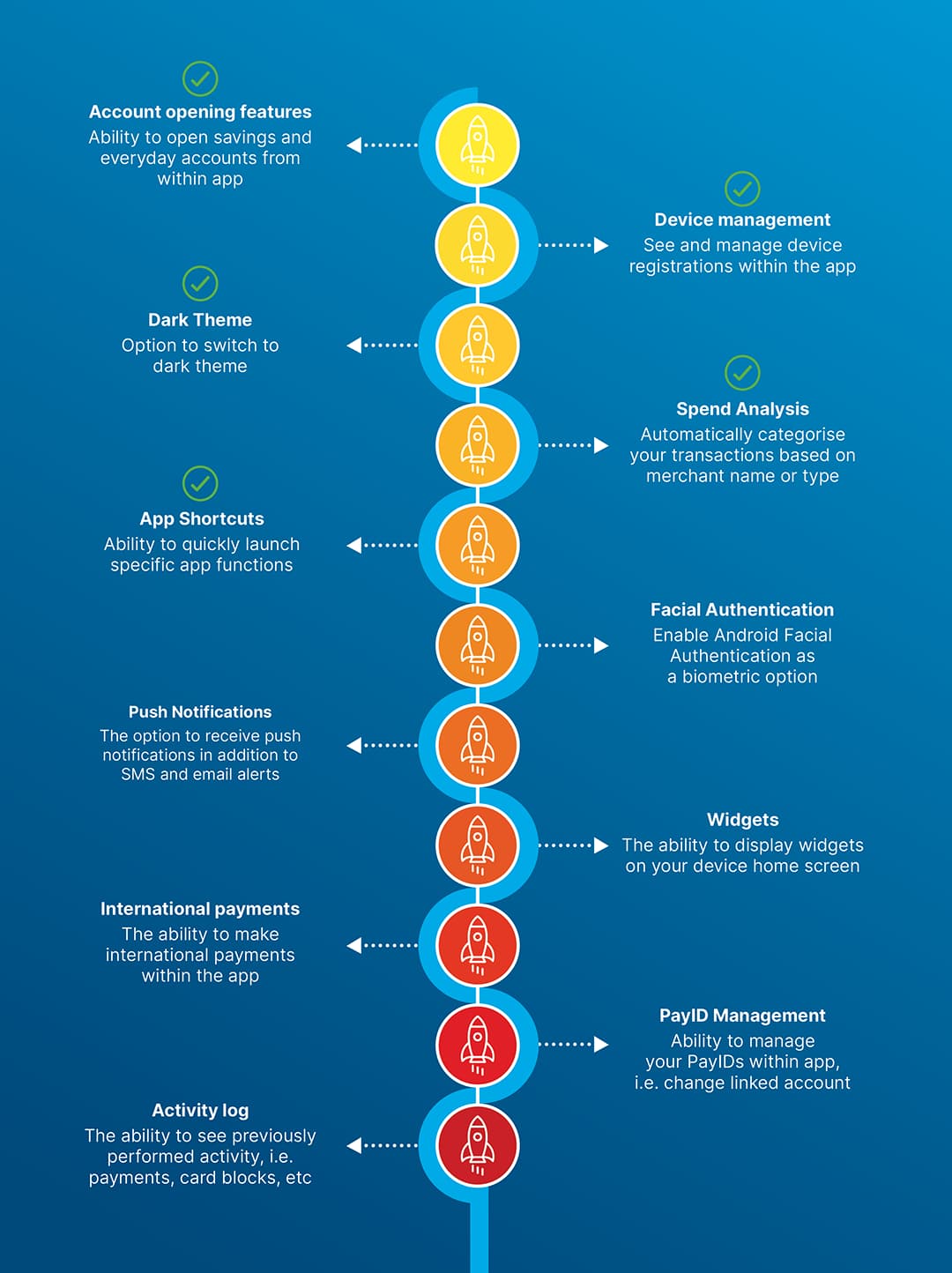

Our mobile banking roadmap

Snapshot of new features that will be released over time

FAQs

What devices will the app work on?

The app will work on Android devices (version 7 and above) and iOS devices (iOS 11 and above)

What are the app features?

The app allows you to complete your everyday essential banking functions on your mobile phone. You can view your accounts and check account balances; transfer funds between your own accounts, utilise Pay Anyone functionality and pay bills via BPAY®, including setting up new billers. The app also has a branch locator, as well as card functions that allow you to change the PIN on any of your cards, or report them lost or stolen.

How do I get the app?

You can download the app "Australian Military Bank" from the Google Play or Apple App Store.

How do I register?

When you first download the app, hit 'login' to start the registration process. You'll need:

- your member number

- the answer to your secret question

- to create a passcode - we will not accept consecutive numbers like 1234, or repeated numbers such as 0000

I have forgotten the answer to my secret question, what do I do?

To reset your secret question please visit Internet Banking > My settings > Update my secret question.

What happens if I enter my secret question incorrectly?

You will have 10 attempts to answer your secret question. After 10 unsuccessful attempts your app will be locked. You will need to contact us to unlock your app - 1300 13 23 28.

How do I create a passcode?

Select 4 digits that you'll remember, for security reasons we will not accept consecutive numbers like 1234, or repeated numbers such as 0000.

What happens if I enter my passcode incorrectly?

You will have 3 attempts to enter the correct pass code when accessing the app. After 3 unsuccessful attempts your app will be locked. You will need to contact us to unlock your app - 1300 13 23 28. If you have forgotten you can follow the "Forgot my passcode" link on the screen.

How do I set up fingerprint or FaceID (biometrics)?

When you first register for the app you'll be prompted to set-up biometrics, if you choose to do so at a later time visit 'Menu', then 'Settings', 'Security' then 'Biometric authentication'. Please note that FaceID is only available for iOS at this stage and Facial Authentication for Android will be coming soon.

What is a One Time Password (OTP)

OTP is a secondary authentication process which is used to confirm your identity and help keep your accounts and information secure. You will be able to receive your OTP via SMS and email.

What kind of payments can I make with the app?

You can make internal and external transfers, real-time payments using PayID and BPAY bill payments.

Are there payments limits on the app?

Payments made using PayID (real-time payments) = maximum AUD $1,000 per transfer with a daily limit of $10,000. You can change your limits via the app Mobile Banking, visit 'menu', then 'settings', then 'Manage limits'

Can I manage my future payments via the app?

Yes visit 'payments' then 'My payments'

What information does the app store on my phone?

The app does not store any data or your phone except for your member and in-app preferences such as quick balance.

Does the app require a WIFI connection?

No, the app will perform all functions on either a WIFI or phone connection such as 4G. The processing times will vary according to your connection.

Can I register the app on more than one device?

Yes. You can register the app on multiple devices, including a combination of both Android and iOS devices.

What do I do if I lose my phone, or my phone is stolen?

Contact us on 1300 13 23 28. You can also manage your account via Internet Banking by selecting the ‘Manage Cards’ option from the ‘Accounts’ screen, and then selecting ‘Report Lost or Stolen Card’. This will cause all transactions attempted on the card to be declined, including any recurring payments, balance updates and transfers performed via the app.

Can I change my card PIN via the app?

You can change your PIN using the app by selecting the ‘Cards’ tab from the Account Dashboard, then 'Manage', and then selecting ‘Change PIN’. You will need to authenticate via OTP or biometrics, then enter a new PIN, confirm this new PIN and then select ‘Update’. The change of PIN is effective immediately.

Can I report my card as lost or stolen?

You can report a card lost or stolen by selecting ‘Cards’ tab from the Account Dashboard, then 'Manage' and then selecting ‘Replace Card’. You will then need to confirm whether the card is lost or stolen or damaged and finally select ‘continue’ to confirm the action. This will cause all transactions attempted on the card to be declined, including any recurring payments, balance updates and transfers performed via the app. Your digital replacement card should be available via the app for mobile payments within 3 hours.

How do I register a travel notification via the app?

Visit 'Menu', then 'Travel Notification', fill out your Departure and Return details.

© Australian Military Bank 2025

Australian Military Bank Ltd ABN 48 087 649 741

AFSL and Australian Credit Licence Number 237 988.